The Facts About Custom Private Equity Asset Managers Revealed

Wiki Article

Things about Custom Private Equity Asset Managers

(PE): spending in firms that are not publicly traded. About $11 (https://cpequityamtx.start.page). There may be a few points you do not understand regarding the sector.

Personal equity firms have a variety of financial investment preferences.

Because the best gravitate towards the bigger deals, the center market is a dramatically underserved market. There are more sellers than there are highly seasoned and well-positioned finance specialists with comprehensive buyer networks and resources to manage an offer. The returns of exclusive equity are usually seen after a couple of years.

Excitement About Custom Private Equity Asset Managers

Flying below the radar of large multinational companies, a lot of these small firms usually provide higher-quality client service and/or particular niche product or services that are not being used by the big empires (https://soundcloud.com/cpequityamtx). Such advantages bring in the rate of interest of private equity companies, as they possess the insights and smart to manipulate such chances and take the business to the next level

Personal equity financiers should have trusted, qualified, and reliable administration in position. Most supervisors at profile business are given equity and incentive compensation frameworks that award them for striking their financial targets. Such alignment of goals is generally called for before a bargain gets done. Exclusive equity possibilities are frequently out of reach for people who can not spend countless bucks, yet they shouldn't be.

There are policies, such as limitations on the aggregate quantity of cash and on the number of non-accredited financiers. The exclusive equity business draws in several of the very best and brightest in corporate America, including top performers from Fortune 500 business and elite monitoring consulting firms. Law practice website here can likewise be hiring grounds for exclusive equity hires, as accountancy and lawful skills are needed to full deals, and transactions are highly looked for after. https://www.anyflip.com/homepage/hubrh#About.

Our Custom Private Equity Asset Managers Diaries

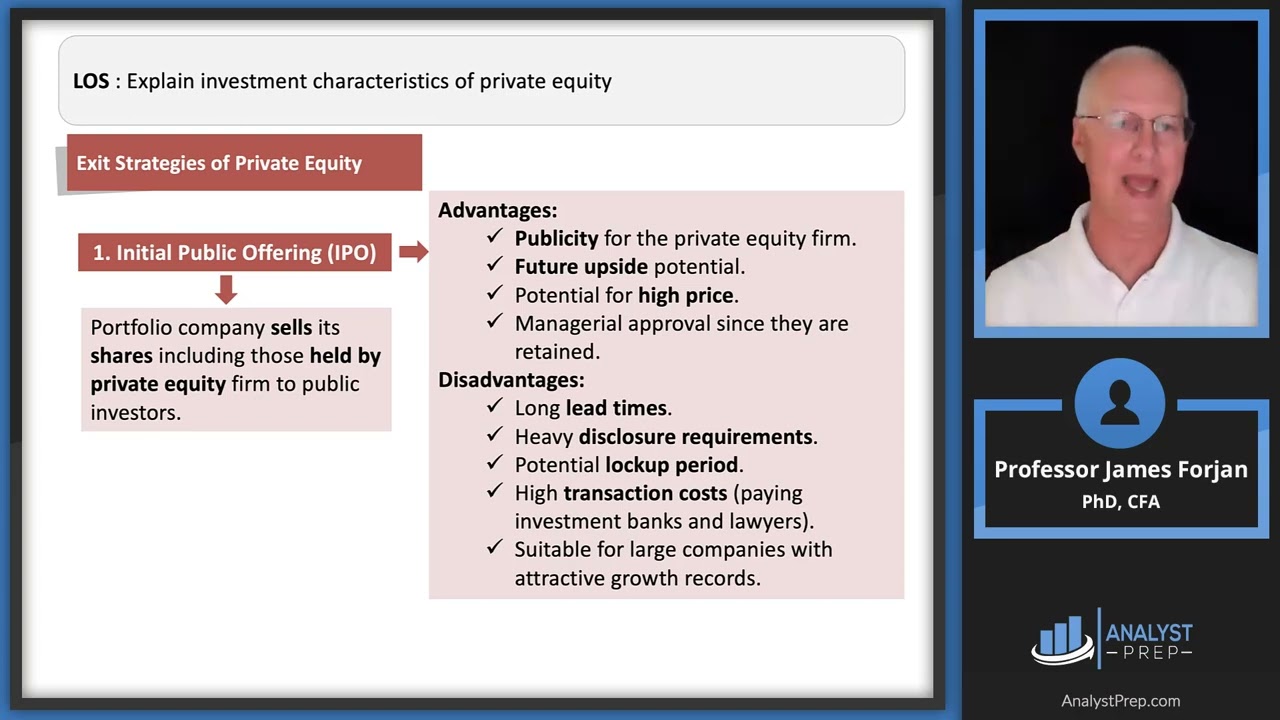

An additional disadvantage is the absence of liquidity; as soon as in a personal equity purchase, it is difficult to leave or market. There is an absence of flexibility. Private equity additionally includes high charges. With funds under administration already in the trillions, exclusive equity firms have actually come to be appealing investment cars for wealthy individuals and institutions.

Currently that accessibility to exclusive equity is opening up to even more individual financiers, the untapped capacity is ending up being a truth. We'll start with the major debates for spending in private equity: Just how and why exclusive equity returns have historically been higher than other assets on a number of levels, How including exclusive equity in a profile impacts the risk-return profile, by helping to expand versus market and cyclical risk, Then, we will outline some key factors to consider and threats for exclusive equity financiers.

When it involves presenting a brand-new possession right into a portfolio, the a lot of standard consideration is the risk-return account of that possession. Historically, personal equity has actually exhibited returns comparable to that of Emerging Market Equities and greater than all other traditional asset courses. Its fairly reduced volatility combined with its high returns makes for an engaging risk-return profile.

All About Custom Private Equity Asset Managers

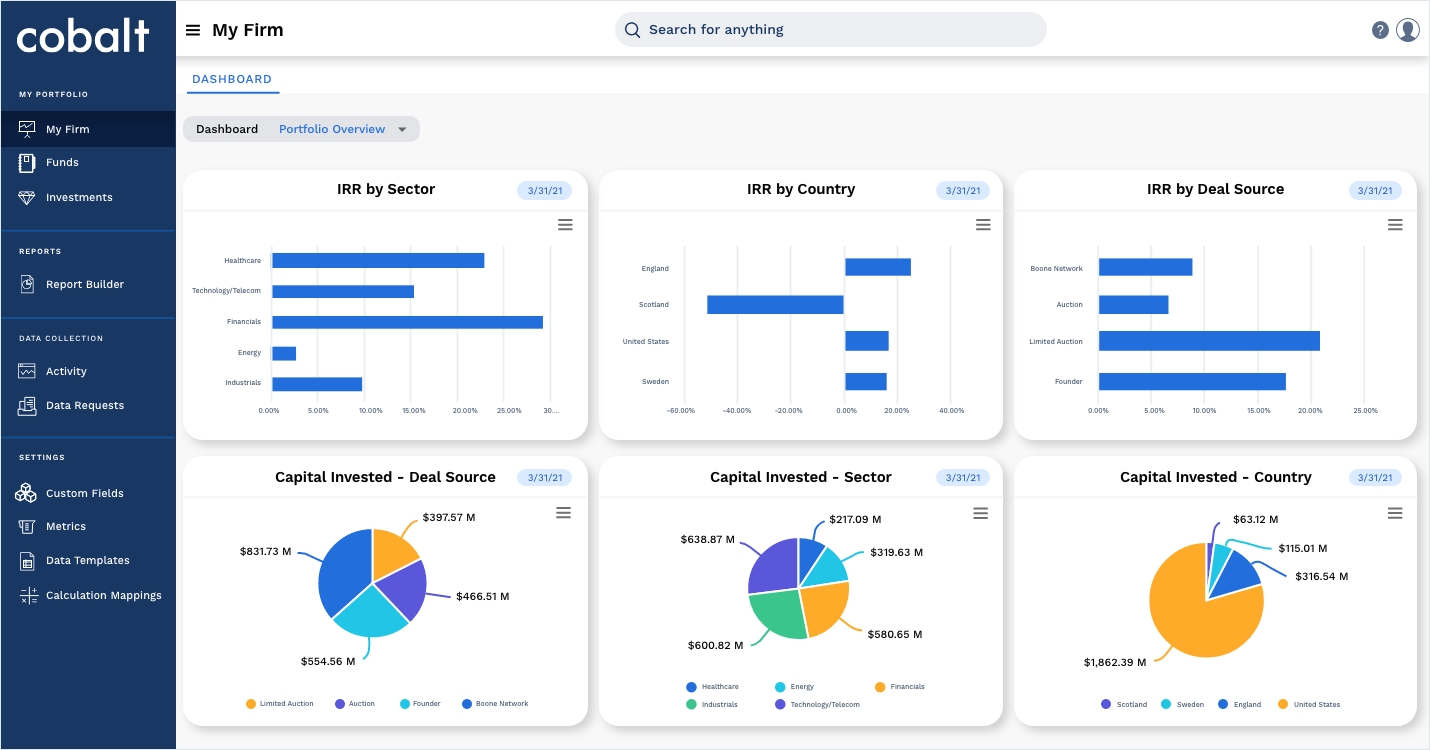

In reality, private equity fund quartiles have the largest array of returns throughout all different possession classes - as you can see listed below. Methodology: Interior price of return (IRR) spreads determined for funds within vintage years individually and after that averaged out. Mean IRR was calculated bytaking the average of the mean IRR for funds within each vintage year.

The result of adding exclusive equity into a profile is - as always - dependent on the portfolio itself. A Pantheon research from 2015 suggested that consisting of personal equity in a portfolio of pure public equity can open 3.

On the various other hand, the very best personal equity firms have accessibility to an even bigger pool of unidentified opportunities that do not face the exact same analysis, as well as the resources to do due persistance on them and recognize which deserve purchasing (Private Equity Platform Investment). Investing at the ground flooring suggests greater danger, however, for the firms that do succeed, the fund gain from higher returns

Custom Private Equity Asset Managers - Questions

Both public and private equity fund managers dedicate to investing a percent of the fund however there stays a well-trodden concern with straightening interests for public equity fund administration: the 'principal-agent issue'. When a financier (the 'primary') works with a public fund supervisor to take control of their resources (as an 'representative') they pass on control to the manager while retaining ownership of the assets.

When it comes to exclusive equity, the General Companion does not simply make an administration charge. They additionally earn a percentage of the fund's revenues in the form of "carry" (usually 20%). This ensures that the interests of the manager are aligned with those of the investors. Exclusive equity funds also mitigate an additional type of principal-agent problem.

A public equity financier ultimately desires something - for the administration to enhance the supply cost and/or pay returns. The investor has little to no control over the choice. We revealed above the number of personal equity techniques - especially bulk buyouts - take control of the operating of the firm, making sure that the long-term worth of the business precedes, raising the return on investment over the life of the fund.

Report this wiki page